These Mid-Size Art Galleries Are Punching Way Above Their Weight. How? By Sharing Profits and Production Costs

Prohibitively expensive projects become much more feasible with shared resources.

Earlier this year, six dealers from around the world that represent the veteran painter Rochelle Feinstein came up with a bold plan for how to show her work.

The heads of the galleries at Nina Johnson, Bridget Donahue, Hannah Hoffman, Francesca Pia, Candice Madey, and Campoli Presti agreed to stage a multi-chapter show of Feinstein’s work in two rounds across multiple time zones and countries.

In late January, Johnson, Donahue, and Madey opened concurrent shows in Miami and New York. This past weekend, on February 12, Hoffman in L.A., Pia in Zurich, and Presti in Paris opened their own exhibitions of Feinstein’s paintings. Think of it as one large exhibition with a shared checklist, taking place in multiple rooms—the major difference being that each is in a different corner of the world. Cheekily, Feinstein gave all six shows the same title: “You Again.”

The idea, Johnson told Artnet News, was to do something unprecedented for an artist.

“Without being a big multinational gallery, we wanted to figure out to produce a show that allows for a rich understanding of Rochelle’s work,” Johnson said.

Financially, the plan relied on a unique profit-sharing model, with 30 percent of all sales going to the gallery that sold the work; 50 percent going to Feinstein; and 20 percent to be shared in a pool for the five other dealers. Works range from $40,000 to $250,000.

The point, Johnson said, was to “be effective as a band of smaller dealers. What can we do for this person that has not been done before?”

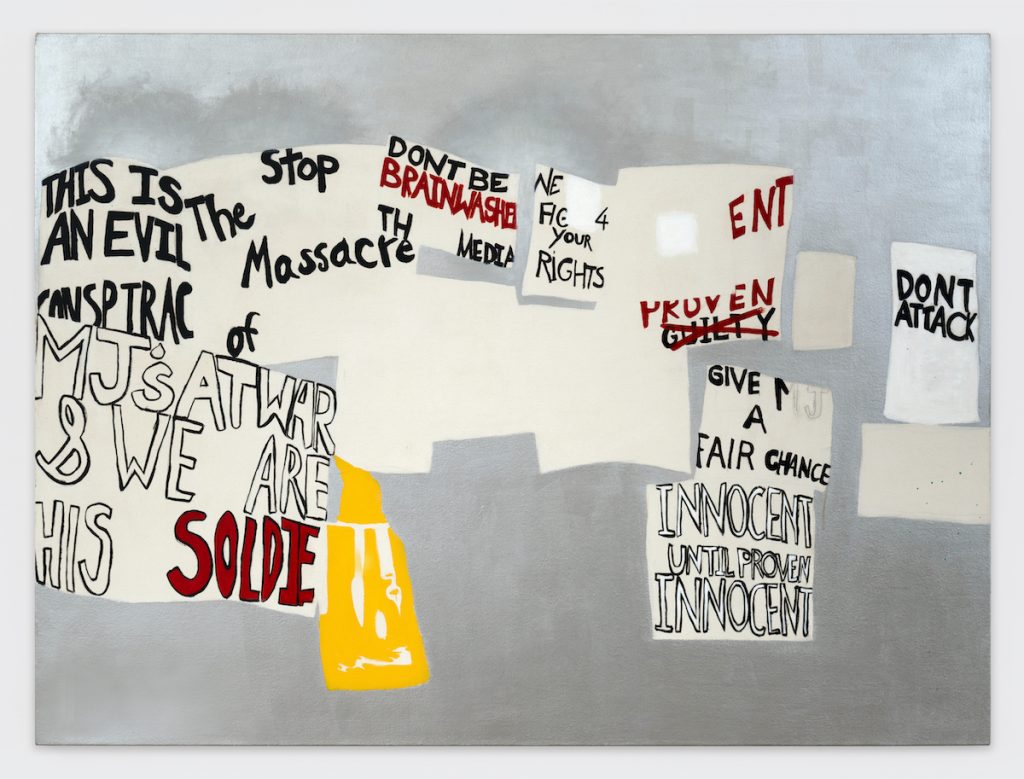

Rochelle Feinstein, The Little Engine (2005–08). Images courtesy Hannah Hoffman Gallery, Los Angeles. Photo: Greg Carideo.

Taking on the Big Dogs

Natasha Degen, art-market studies chair at New York’s Fashion Institute of Technology, says that collaborations between dealers have a long history. Leo Castelli, for example, organized joint exhibitions in a “divide-and-conquer approach” with younger gallerists who were more tuned into emerging scenes throughout the 1980s.

“His partners benefitted from his imprimatur, as well as his client list,” she told Artnet News.

Yet more than ever, old business formalities are being thrown out the window entirely. Mega-dealers like David Zwirner have their own online sales platforms; regional powerhouses like Johann König are hosting auctions and art fairs; and others, like Dominique Lévy, Brett Gorvy, Amalia Dayan, and Jeanne Greenberg Rohatyn are joining together to create conglomerate operations like LGDR, their new international dealership formed upon the dissolution of Salon 94, Luxembourg and Dayan, and Lévy Gorvy.

For smaller organizations, working together isn’t simply about sharing space, as per the Condo model, a roving gallery-share initiative in which local dealers hosted out-of-town gallerists staging temporary shows. Collaboration is now also about sharing in financial gains and losses: The New Art Dealers Alliance (NADA) pioneered the model when 40 percent of the proceeds from any sales in its May 2020 online viewing room went into a community pool for all exhibitors and artists.

“Now that the market is so strong, we have a real chance to make the model work successfully,” art dealer Jeffrey Rosen, a longtime member of NADA, told Artnet News. “The moment is ripe for this model, but the question is whether the motivation can be maintained in the absence of the uncertainty we all felt in 2020.”

There is gathering evidence that the approach is sustainable—or at least, of some interest to dealers. In New York, a show by Nick Relph recently opened as a co-production by Herald St gallery and Gordon Robichaux. And in January, Mendes Wood DM and Clearing worked together on a two-part show in Brussels by artist Neïl Beloufa that the galleries say would have been impossible to organize alone.

“As the production for this exhibition was very high, especially the immersive installation at Clearing’s space, we decided that everything should be split evenly,” said Pierre Lannoy, a sales associate at Mendes Woods DM. They also agreed to check in before any sales are closed on either side. Works range from €20,000 to €90,000.

For some artists, the model works particularly well: the 74-year-old Feinstein, who has been painting for nearly five decades, makes work that is “really about questioning hierarchies,” said Leo Lencsés of Francesca Pia gallery.

“She has a lot of institutional recognition in Europe,” he said. “In the U.S., her market is a little stronger. Profit-sharing helps to level out these preconditions that every partner has in this game.” That kind of matchmaking “really takes the edge off” for dealers, Johnson added.

Yet Rosen cautions that, for the model to work, it requires substantial communication and a spirit of collaboration. “You really need everyone to be cooperating and supportive of each other. The numbers will not work unless the galleries who sell are totally willing to help out those who do not.”

But when the model is successful, it lets dealers execute plans that only much richer competitors generally can undertake, all without becoming overly corporatized.

“Galleries of our scale can offer something that you just cannot get at the level of behemoths,” Johnson said. “That is a personal and emotional touch.”